by PSA CPA | Jan 1, 2024 |

As tax season approaches, keep an eye out in the mail for envelopes labeled “tax information.” Among the numerous items they may include are several sorts of 1099 tax forms. But what are they used for, and why are they required? Let ‘s see. A 1099...

by PSA CPA | Jan 1, 2024 |

The Corporate Transparency Act (CTA) has gone into effect as of January 1, 2024, affecting millions of small businesses across the United States. Understanding the complexities of this legislation and its possible implications is critical for small companies....

by PSA CPA | Aug 16, 2023 |

Opening an additional location for a business is a significant choice that can have long-term consequences for your company. Finance executives have a critical role in making the best choice, particularly in terms of cost. Work with Human Resources Firstly, the HR and...

by PSA CPA | Aug 16, 2023 |

When a family member hires an individual, the tax consequences vary depending on the connection to that family member, and the business type. It is critical that individuals and employers know their tax status. Here’s what you should know: Married people in business...

by PSA CPA | May 1, 2023 |

There are several parallels between being self-employed and owning a small business. For instance, both empower you to be your own boss! However, when it concerns filing taxes and reporting company revenue, your official business classification might signify quite...

by PSA CPA | Mar 1, 2023 |

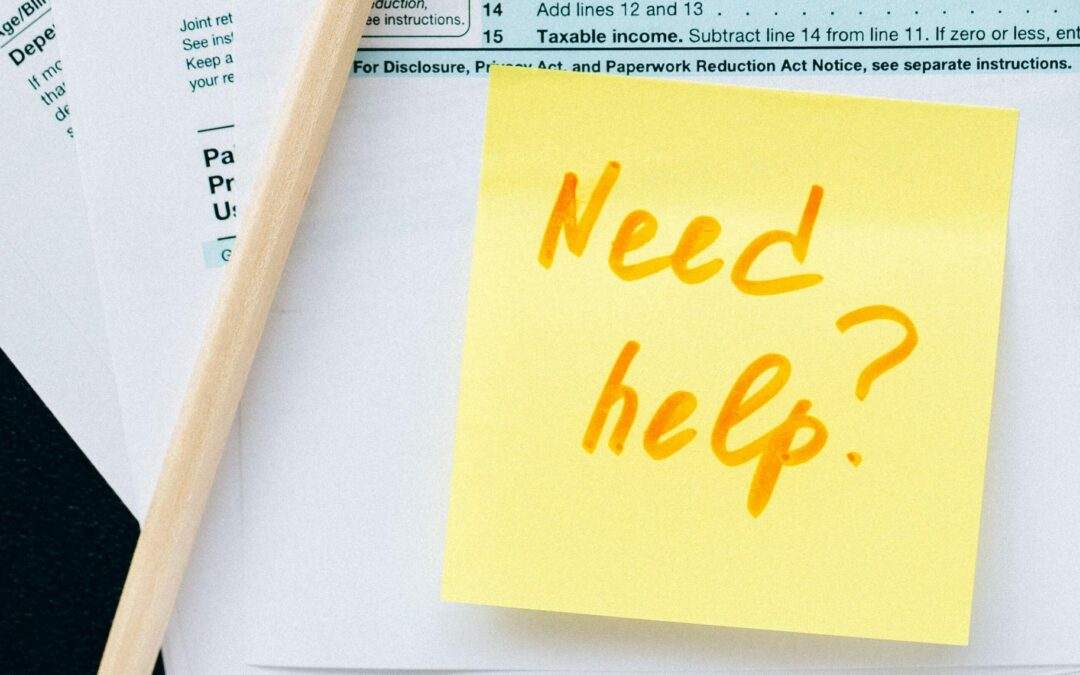

On December 23, 2022, the IRS stated that it would postpone the $600 reporting requirement for Form 1099-K that was scheduled to take effect during the 2022 tax year. Instead, these obligations have been delayed by one year to give people more time to prepare. Form...

It’s interesting to see how Social Security benefits are taxed differently depending on income and location. I didn’t realize only…