by PSA CPA | Feb 1, 2024 |

Tax season is here, which means spring is just around the corner. It’s the time of year when we look forward to better weather and tax refunds, but beware: tax season is also scam season. In recent years, the IRS has observed an increase in tax fraud, such as...

by PSA CPA | Jan 1, 2024 |

With tax season on the way, the IRS reminds businesses that the deadline for filing pay statements and paperwork for independent contractors to the government is Jan. 31. Employers must submit copies of Forms W-2, Wage and Tax Statement, and W-3, Transmittal of Wage...

by PSA CPA | Jan 1, 2024 |

The Corporate Transparency Act (CTA) has gone into effect as of January 1, 2024, affecting millions of small businesses across the United States. Understanding the complexities of this legislation and its possible implications is critical for small companies....

by PSA CPA | Jan 1, 2024 |

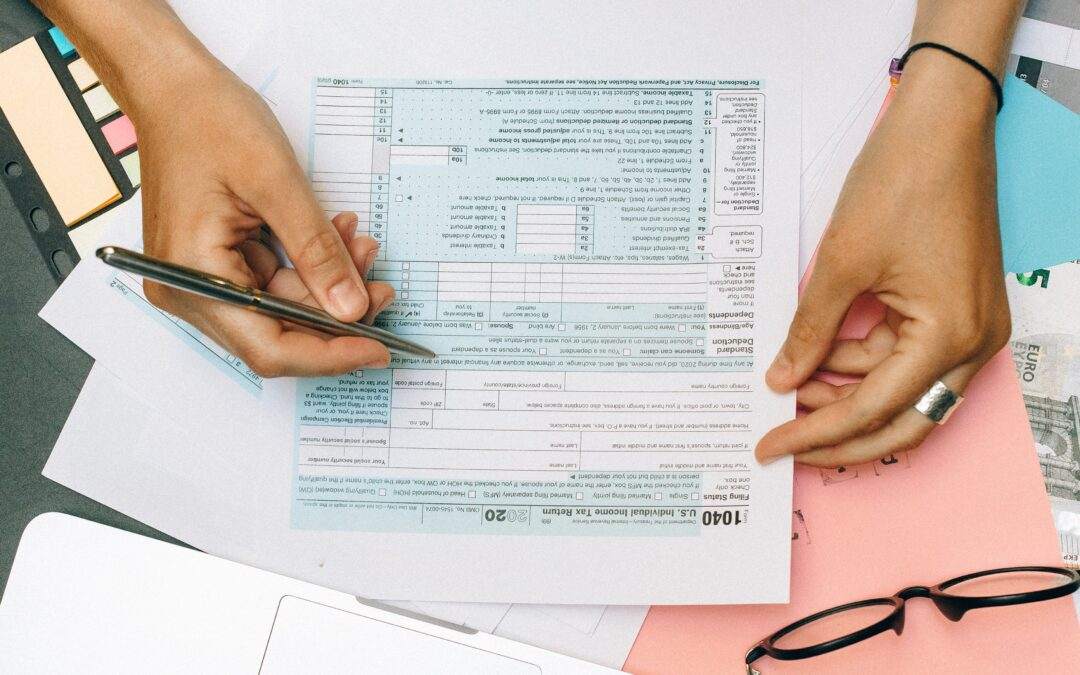

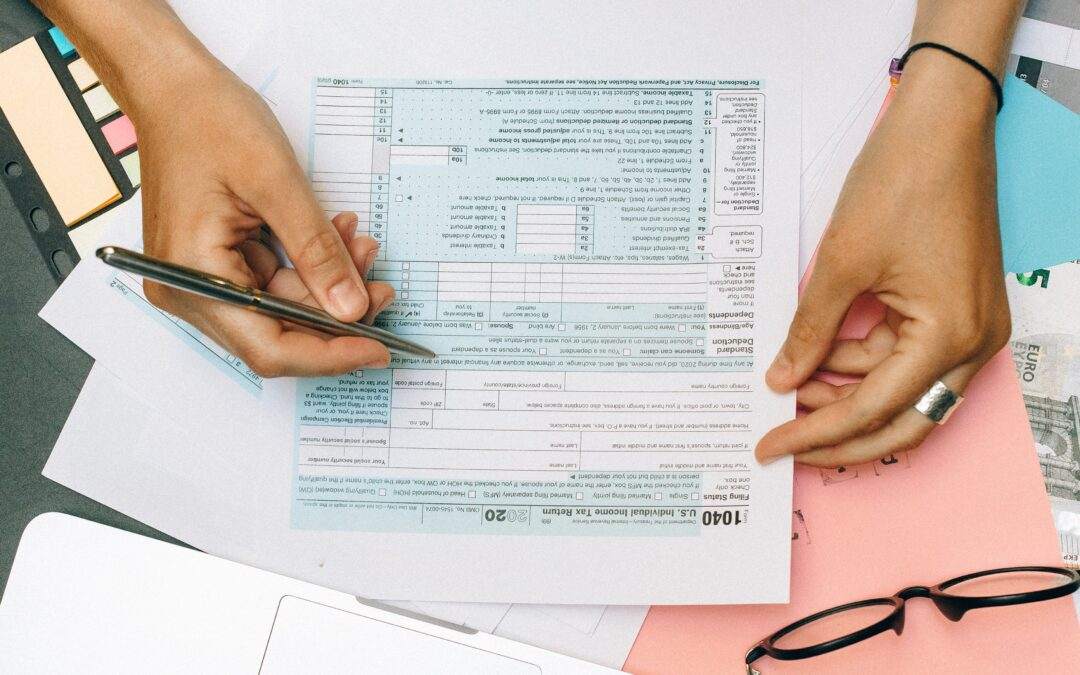

As taxpayers prepare for tax filing season, it is critical that they choose tax return preparers that have the necessary skills, education, and knowledge to file tax forms correctly. Taxpayers are ultimately accountable for all the information on their tax returns,...

by PSA CPA | Nov 1, 2023 |

A tax rate is the percentage (0-100%) of your income that is taxed. Taxes are amounts deducted from money that you own or earn. Income tax is the most common application of a tax rate. To demonstrate this notion, consider someone who recently received $50 for a...

by PSA CPA | Sep 19, 2023 |

If your income changes from yearly, you may find yourself spending more in taxes than you anticipated. This is due to the fact that when your income rises, you may be forced into a higher tax band, resulting in greater tax rates for higher income levels. So, how can...

It’s interesting to see how Social Security benefits are taxed differently depending on income and location. I didn’t realize only…