by PSA CPA | Apr 1, 2023 |

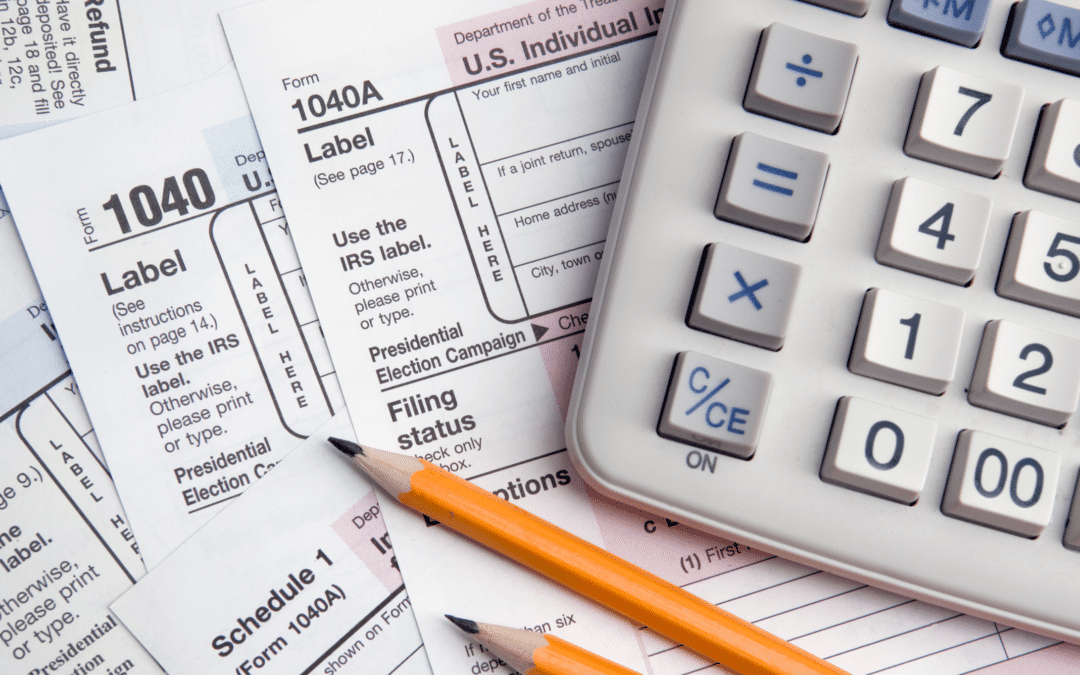

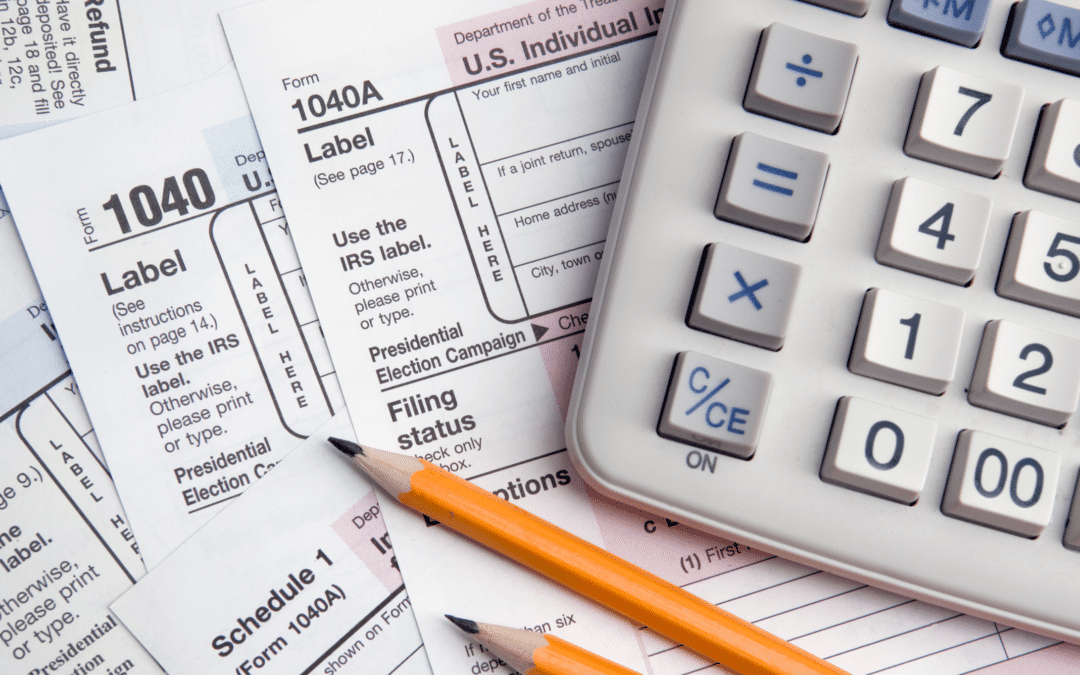

If you, your spouse, or dependents had considerable medical or dental expenditures in 2022, you may be eligible to deduct those costs when filing your tax return this year. What you should know about medical and dental bills, as well as other benefits: Itemizing: Only...

by PSA CPA | Apr 1, 2023 |

Every season, married couples can choose to submit their taxes jointly or individually. While filing jointly usually pays off, separating returns may be preferable in some cases, according to financial experts. Married couples filing separately must file two separate...

by PSA CPA | Mar 1, 2023 |

Are you married to a nonresident alien? You can file alone or jointly with your nonresident foreign spouse, but every option has consequences. It’s typical for US residents to marry foreigners while they are employed and living overseas, and as with many other life...

by PSA CPA | Jan 1, 2023 |

President Biden passed the $1.66 trillion Consolidated Appropriations Act on December 29, 2022. The SECURE Act 2.0 of 2022, which incorporates a variety of tax measures linked to retirement, is included in the 4,155-page law. Let’s go through the highlights: Automatic...

It’s interesting to see how Social Security benefits are taxed differently depending on income and location. I didn’t realize only…