Nonprofit Financial Readiness: Practical Steps to Stay Compliant

For many nonprofit owners, financial compliance can feel overwhelming. In reality, readiness is not about scrambling at year-end. It is about maintaining strong financial systems throughout the year.

With the right processes in place, nonprofits can reduce compliance risk, protect tax-exempt status, and strengthen donor confidence.

Common Compliance Risks

Nonprofits often face challenges such as:

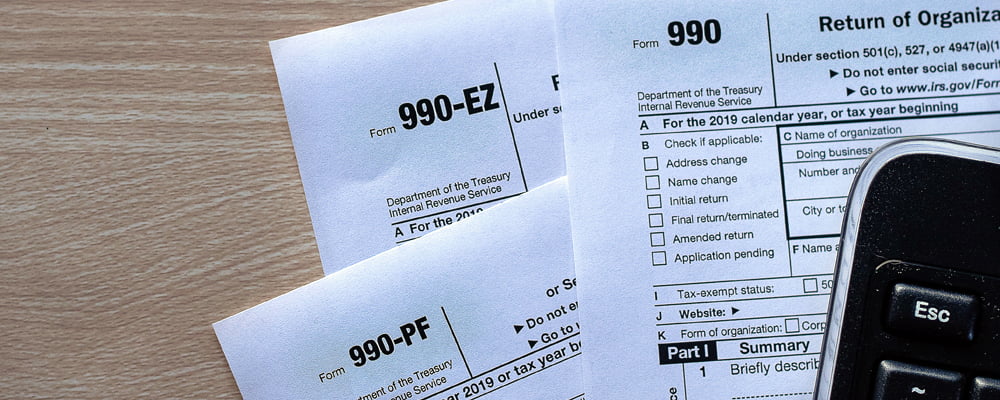

- Incomplete or late Form 990 filings

- Weak internal controls

- Inaccurate financial reporting

- Poor tracking of restricted grant funds

Even small errors can affect funding, transparency, and regulatory standing.

Three Practical Steps to Stay Financially Prepared

1. Strengthen Internal Controls

Clear approval procedures and separation of duties reduce risk. Establish defined authorization thresholds and ensure transactions are properly documented and reviewed.

Strong internal controls are essential for nonprofit financial compliance.

2. Reconcile Accounts Monthly

Monthly bank and credit card reconciliations prevent errors from compounding. Regular review of financial activity helps ensure records are accurate throughout the year.

Consistent reconciliation supports informed decision-making and reduces reporting issues..

3. Prepare for Form 990 Early

Form 990 preparation should begin months before the deadline. Gathering financial data, reviewing governance disclosures, and tracking restricted funds early reduces filing errors and stress.

Early preparation supports nonprofit compliance and helps maintain transparency with donors and stakeholders.

Build Compliance Into Your Organization

Financial readiness should be part of your nonprofit’s culture. Board oversight, consistent reporting, and documented procedures help ensure transparency and long-term sustainability.

How PSA CPA Can Help

PSA CPA works with nonprofit organizations in Rockville and the D.C. Metro area to strengthen internal controls, maintain accurate financial records, and prepare Form 990 filings.

As a trusted Maryland CPA firm, we provide accounting and tax guidance to help nonprofits meet reporting requirements and maintain compliance.

Proactive preparation protects your mission and strengthens donor confidence.

📞 (301) 879-0600

✉️ contact@psacpa.com

Disclaimer: This article is for informational purposes only and does not constitute legal or tax advice.

0 Comments